Don’t Mistake Gold for an Investment Product

If you’ve read my previous blog, you might have noticed that I didn’t include gold among the investment options. That wasn’t an oversight—it was intentional.

Gold is often understood (misunderstood) as an investment asset. However, it functions more like a perfect plug for the hole in ship. It doesn’t push your ship forward, but it helps stop the leak caused by inflation.

Here’s why:

Gold is a store of value - a wealth preserver, not a wealth creator.

It does not generate cash flows (no dividends, no interest, no business growth).

It acts as a hedge against extreme situations (currency devaluation, geopolitical risks, hyperinflation).

Gold’s long-term returns are often just enough to match inflation, unlike equities, which have historically delivered higher real returns.

If all your wealth is in gold, you might not grow further rich, but you also won’t see your wealth lose its purchasing power.

Let’s Look at the Numbers

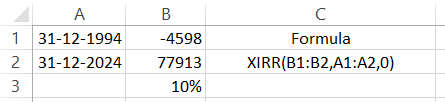

To understand it better, I calculated returns in last 30 years using a simple excel formula - as 10% compounded annually.

(source for gold prices: https://www.bankbazaar.com/gold-rate/gold-rate-trend-in-india.html)

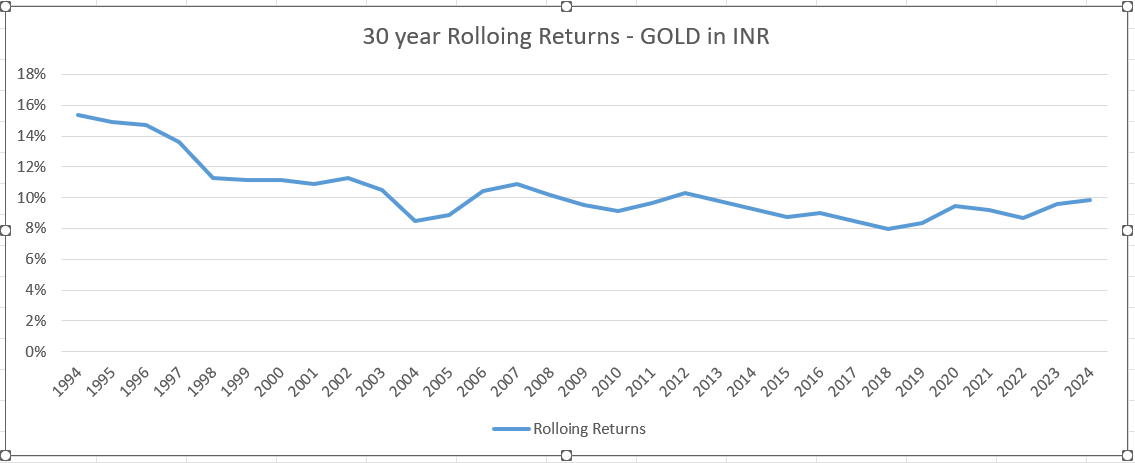

Let’s look at the big picture by smoothening it’s short term volatility. Here is a chart showing 30 year period rolling returns of gold in INR from 1994 to 2024. We can see that for last 26 years (1998 to 2024), the returns are stable between 8% to 12% range.

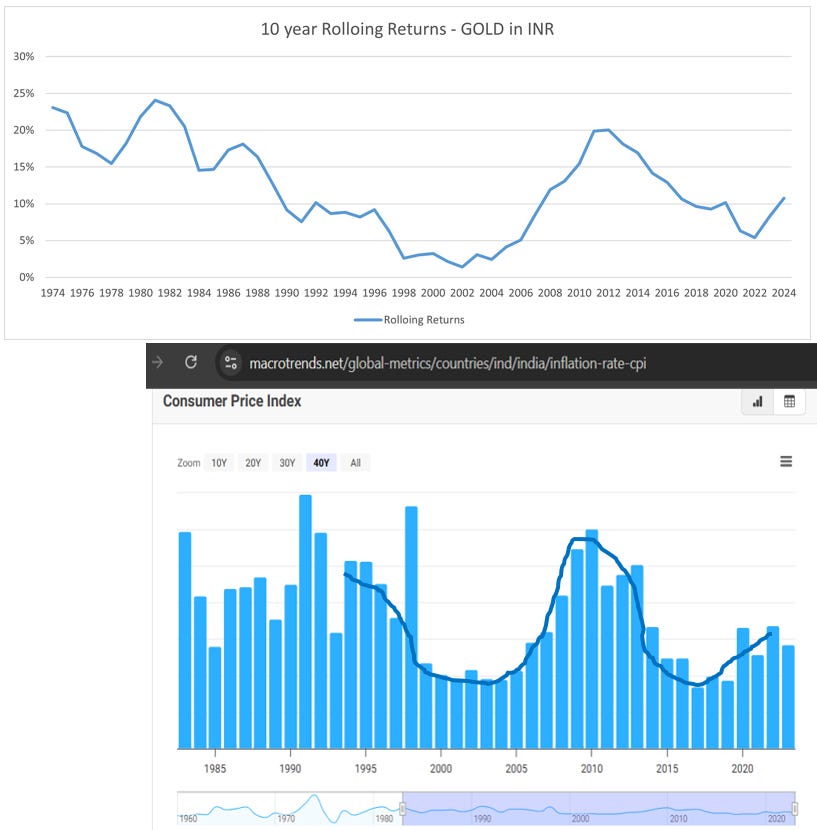

And below is a chart of 10 year period rolling returns of gold, which almost replicates the trend of Consumer Price Index (CPI).

Though gold is volatile in the short term, much of that return reflects currency depreciation and inflation, not real wealth creation.

Therefore, allocating 5-15% of your portfolio in gold can act as a hedge. But relying solely on gold means your ship won’t move forward—it will only keep you afloat.

Gold is your emergency escape plan, not your main strategy in wealth creation.

A Thought Experiment

Imagine if your employer pays you in grams of gold instead of rupees. You’d never need to negotiate an annual raise to beat inflation—because gold inherently holds its value over time.

And if your expenses—groceries, rent, utilities—are also priced in gold, you’d be living in a world where inflation doesn’t affect you.

Of course, this isn’t how real-world economies function. But this thought experiment helps illustrate gold’s power as a stable value reference, even if it’s not a wealth builder.

Final Thoughts

Gold deserves a spot in your portfolio—not for its ability to grow your wealth, but to preserve it during uncertain times. It’s your financial shock absorber. Respect it, but don’t rely on it as your primary engine of growth.

Stick to growth assets like equities for the long haul. And let gold quietly do its job in the background—patching the leaks, keeping you afloat, and adding resilience to your journey.

Footnote:

And when you gift gold to your loved ones next time, tell them you are not just giving them a precious metal - you’re gifting them a wealth preserver.

If you liked this article, share it with your friends and spread the knowledge!

Prasad Yelgodkar

Comments

Post a Comment