The Beauty of CAGR - How One Excel Formula Helped Me Surrender My LIC Jeevan Saral Policy

The year was 2012.

I was four years into my salaried job. EMIs were getting paid on time, expenses were under control, and for the first time, I had a little surplus left at the end of the month. More importantly, I had started building my financial awareness—something my sixteen years of formal education had completely skipped.

Like many curious beginners, I spent weekends scrolling through blogs and forums. Websites like Jagoinvestor and I Will Teach You To Be Rich opened up a new world. Investments were no longer “good” or “bad” products—they were decisions with logic, trade-offs, and consequences.

Where it all started

Back in August 2008, barely two months into my first job, a visit to my hometown resulted in an important financial decision—at least that’s what we believed then.

My father had asked me to subscribe to LIC’s Jeevan Saral.

It was a good intention advice. He wanted me to be insured early, to build a saving habit, and to avoid mistakes he had seen others make. I am genuinely grateful for that intent. Many of my friends and colleagues were doing the same—some LIC policy or the other was almost a rite of passage for salaried employees in those days.

So was it a mistake?

Not really.

It was a well-intentioned decision made with limited information.

The discomfort of new ideas

By 2012, term insurance had entered the conversation. It was strange, unpopular, and uncomfortable.

“Pay money and get nothing back?”

That idea didn’t sit well with most people—including my father and colleagues. I, however, had read enough to feel convinced that insurance and investment should not be mixed.

I thought surrendering my LIC policy and buying a term plan would be a simple decision.

I was wrong.

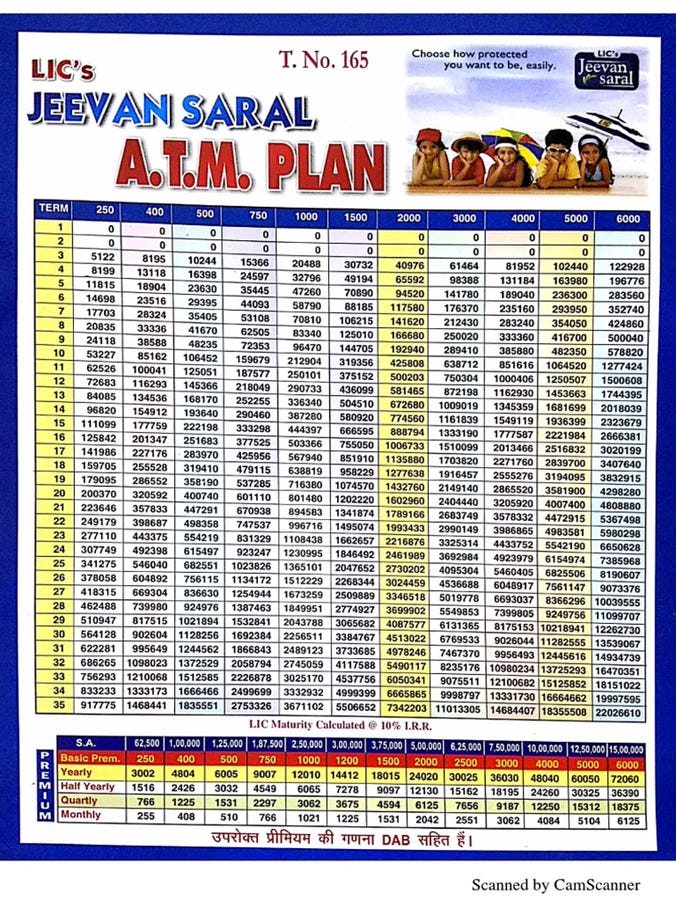

Convincing family was far tougher than reading blogs. During one of the conversations with colleagues, one colleague even pulled up a chart on Google and confidently showed me how my ₹24,000 annual premium would turn into ₹27.3 lakh after 25 years.

That number shook me.

The illusion of large numbers

Digging deeper, I noticed something important.

LIC never mentioned a guaranteed maturity amount on their official website. Only illustrations—based on assumed interest rates of 7%, 9%. Some agents made illustrations with 10% IRR. That ₹27.3 lakh wasn’t promised; it was projected. Once I saw that difference, I couldn’t unsee it.

Still, projections feel real when they’re large.

During one visit to hometown, my father took me to the local LIC agent. This time, instead of listening politely, I asked pointed questions. Slowly, the numbers started shrinking. The maturity estimate fell—from about ₹27 lakh to ₹17 lakh.

Even then, it felt impressive.

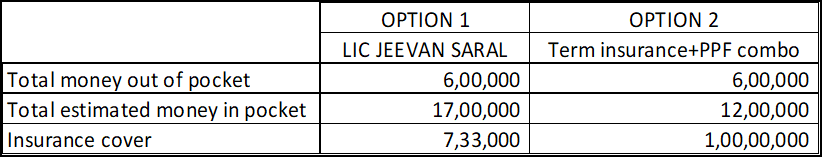

“₹6 lakh (total premiums paid) becoming ₹17 lakh—what’s wrong with that?”

That’s when I stumbled upon something that changed everything.

“But Prasad, you are also getting insurance cover with LIC, …na….”

“And how much is that? 7 lakh….. I am talking about a term cover of 1 crore”

The day CAGR entered my life

One weekend, while experimenting with Excel, I discovered the CAGR (=XIRR) formula.

It was simple.

No drama. No storytelling. No brochures.

When I fed in my LIC premiums and the revised maturity value of 17 Lakh, the result came out to be roughly 7.3% CAGR.

That was my moment of clarity.

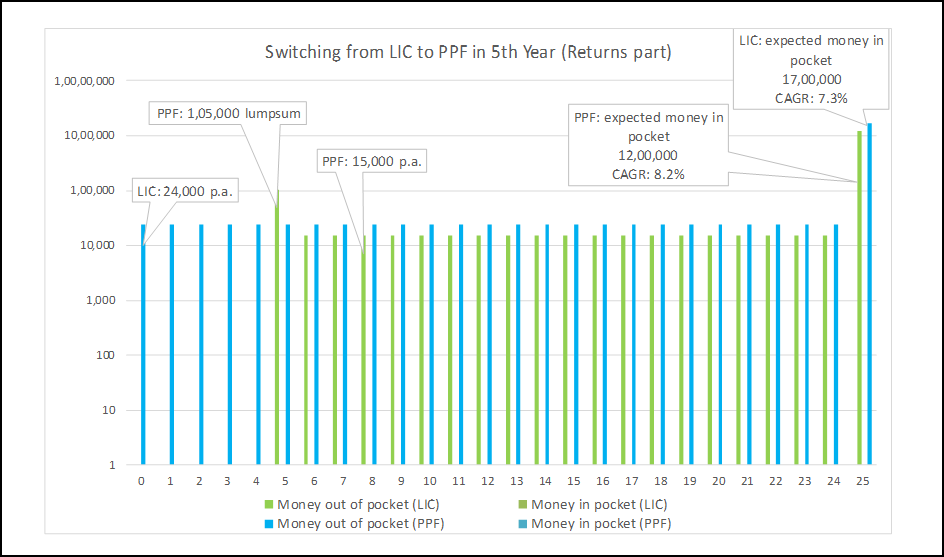

I ran another three step scenario.

(A) If I surrendered the policy, I would get around ₹90,000 (with a loss)

(B) If I bought a term plan for ₹11,000 annual premium

(C) If I invested the ₹90,000 as lumpsum in PPF and the premium difference (₹15,000 annually) into PPF, I would still reach about ₹12 lakh over the remaining period.

Then I decided to compare both options on a simple sheet: same out-of-pocket money, different paths. To test my conviction, I plotted both options over 25 years—and the picture surprised me

Suddenly, the LIC policy no longer looked magical. It just looked… average.

When I compared with the insurance cover, the picture changed even more.

On returns alone, the difference was already uncomfortable. Once I layered in the insurance cover, the LIC policy stopped making sense for my real goal—protecting my family. This comparison helped me to convince my dad.

Why CAGR felt beautiful

It didn’t argue emotionally. It didn’t judge intent.

It simply asked one honest question: “How fast did your money really grow?”

Among all financial metrics, CAGR possesses a rare elegance—ruthless simplicity combined with profound truth.

It forgives the ugly middle. It ignores noise. It respects time.

That single formula helped me make peace with surrendering my LIC policy—not out of rebellion, but out of understanding.

Since then, CAGR has become my default lens for judging any long-term product, no matter how glossy the brochure looks.

Comments

Post a Comment